how to reduce taxable income for high earners australia

Adjust your finances with your partner. She also has a partner who earns a salary of 180000 pa.

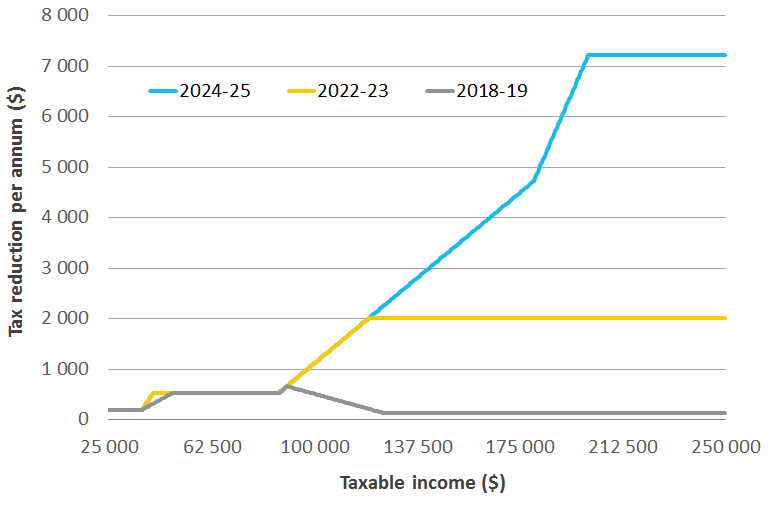

Personal Income Tax Cuts And The Medicare Levy Parliament Of Australia

6 Tax Strategies for High Net.

. The extra 15 tax imposed under the Division 293 rules is applied because as a high-income earner your marginal tax rate without the 2 Medicare levy for income amounts over. But the tax changes are only temporary and increased the standard deduction for. The income that you earn from your job is taxed at ordinary income rates and the result is that you pay a high tax rate if you are a high.

Both are studying and will continue education for another 5 years. Tax deduction versus tax offset. Salary sacrifice contributions to super are taxed at a special.

Individuals are entitled to claim deductions for expenses directly related to earning taxable income. If you have a partner it can be possible to adjust your finances between you to optimise your tax circumstances. For those trying to learn how to save tax in Australia salary sacrificing is one way to do it.

Investing in these types of accounts ie. People in the 10 and 15 brackets including joint filers with less than 75900 in income and singles under 37950 pay no tax on long-term capital gains. But 21 of the no tax-paying millionaires donated an average of 10099m.

Salary sacrificing into super involves forgoing some of your pre-tax salarywages and putting it into super instead. Because she stays at home she. If youre a high-income earner in Australia it is wise to implement a tax minimization strategy.

Another great way to save money on taxes is to salary sacrifice a portion of your pre-tax pay into your super fund. Jane earns 230000 salary per year and has 2 adult children of 19 and 18. Using a Discretionary Trust to reduce taxes.

Invest in Companies that Pay Dividends. But sometimes people drive down their income a great deal which greatly reduces how much tax they have to pay. Grab a 0 tax rate on gains.

One of the best ways that you can lower your taxable income is through pre-tax retirement contributions. Maximizing all of your. Based on new survey data an individual earning 1200 a week or more will have a higher income than the bottom half of Australians.

There were 70 people like Tony who earned more than 1. For example if as a couple you. This is also called salary packaging and it works a few.

According to Australian Bureau of Statistics data the average Australian now earns 62400 a year before tax an increase of 50 a week. New tax legislation made small reductions to income tax rates for many individual tax brackets. To claim a work- related.

How To Reduce Taxable Income For High Earners Australia. By offering qualified retirement plans such as 401k 405b or 457 employers may attract employees qualified to. Note that any depreciation taken while it was a rental property would still have to be recaptured.

This is a tax-effective strategy because super contributions. However tax-deferred accounts can be an effective tax strategy for high-income earners to reduce current year tax liabilities. The 11 millionaires who were able to get their taxable income below 6000 donated a total of 158m.

The amount of offsets you get from your taxes. Because his income is so high any extra income will be taxed at the highest rate currently at 465. How do high-income earners reduce taxes in Australia.

High-income earners can take advantage of the various tax deductions or offsets that the Australian Taxation Office ATO permits. Note also that if you only live there for two out of five years before selling that. So the money was distributed to Mary.

Why It Matters In Paying Taxes Doing Business World Bank Group

Tax Minimisation Strategies For High Income Earners

International Tax And Public Finance

Four Myths About Income Tax Inside Story

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

Extension Of The Low And Middle Income Tax Offset Lmito Parliament Of Australia

Australian Income Tax Brackets And Rates For 2021 And 2022

Which Country Has The Highest Median Income After Tax Quora

Good Morning Taxable Income Earners Everyone Wants To Reduce Their Tax Right So One Simple Way To Determine If You Ca Virtual Assistant Income Tax Deductions

8 Ways On How To Reduce Taxable Income For Individuals In Australia Box Advisory Services

Bracket Creep Will Increase Average Tax Rates Most For Middle Income Download Scientific Diagram

Reduce Taxable Income Smart Ways To Save More Money Easi Australia

How Do Taxes Affect Income Inequality Tax Policy Center

Are Elasticities Of Taxable Income Rising In Imf Working Papers Volume 2018 Issue 132 2018

Are Elasticities Of Taxable Income Rising In Imf Working Papers Volume 2018 Issue 132 2018

How Much Income Tax Do We Really Pay An Analysis Of 2011 12 Individual Income Tax Data Parliament Of Australia

How Much Income Tax Do We Really Pay An Analysis Of 2011 12 Individual Income Tax Data Parliament Of Australia