does florida have capital gains tax on real estate

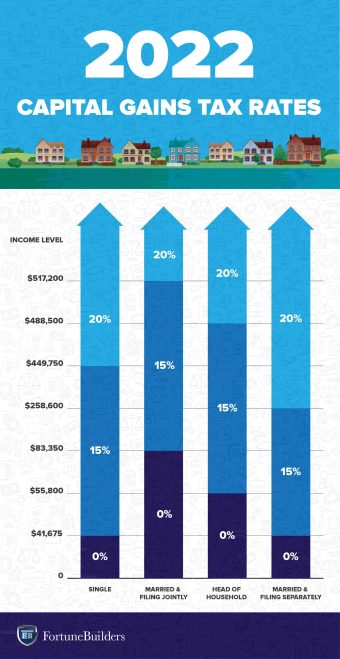

Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or. There is no Florida capital gains tax on individuals at the state level and no state income tax.

Real Estate Capital Gains Tax Rates In 2021 2022

Special Real Estate Exemptions for Capital Gains.

. The IRS typically allows you to exclude up to. The long-term capital gains tax rates are 0 percent 15. What is the capital gain tax for 2020.

The Florida income tax code piggybacks the federal income tax code for treatment of capital gains of corporations. Make sure you account for the way this. It lets you exclude capital gains up to 250000 up to 500000 if filing jointly.

The state of florida does not have a state income tax and it also does not have a capital gains tax regardless of your state of residency. If you owned and lived in the place for two of the five years before the sale then up to. Its called the 2 out of 5 year rule.

Federal long-term capital gain rates depend on your. Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules. Individuals and families must pay the following capital gains taxes.

The State of Florida does not have an income tax for. Capital Gains Taxes Considerations for Selling Florida Real Estate. Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet.

Long-term capital gains tax is a tax applied to assets held for more than a year. 1 week ago Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt. 500000 of capital gains on real estate if youre married and filing jointly.

It depends on how long you owned and lived in the home before the sale and how much profit you made. Heres an example of how much capital gains tax you might. What You Need To Know 2022.

Ncome up to 40400. 250000 of capital gains on real estate if youre single.

Capital Gains Tax Rate In California 2022 Long Short Term Seeking Alpha

Why The House S Proposed Tax Plan Could Set Off The Next Real Estate Recession In Florida South Florida Law Blog

Real Estate Capital Gains Tax Calculator For Nyc Interactive Hauseit

Tax Comparison Florida Verses Georgia

How Much Is Capital Gains Tax On Real Estate Plus How To Avoid It

Capital Gains Tax In Kentucky What You Need To Know

Capital Gains Tax On Real Estate How It Works In 2022 Nerdwallet

Florida Capital Gains Taxes What You Need To Know 2022 Michael Ryan Money

Florida Real Estate Taxes And Their Implications

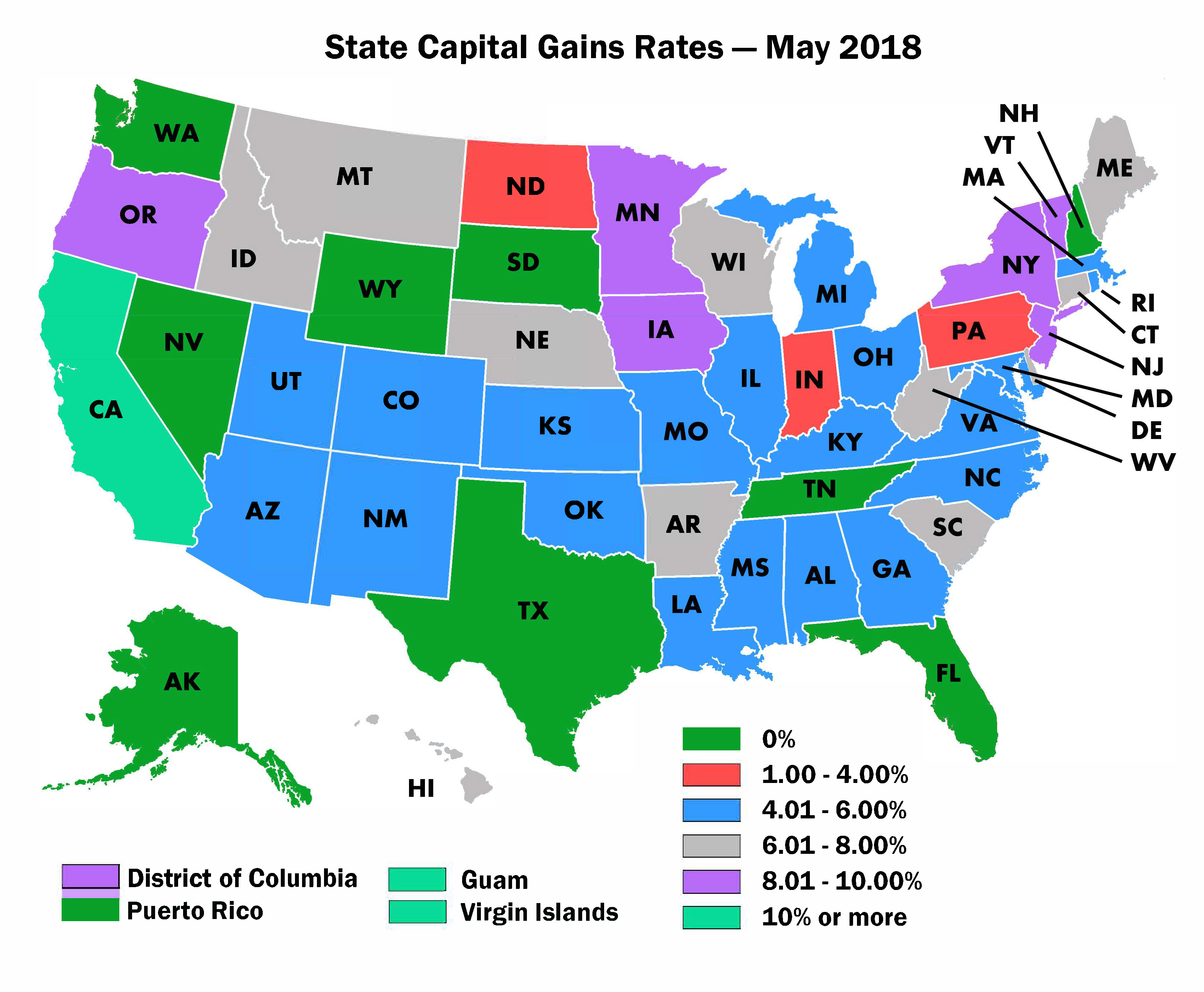

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Foreign Capital Gains When Selling Us And Foreign Property

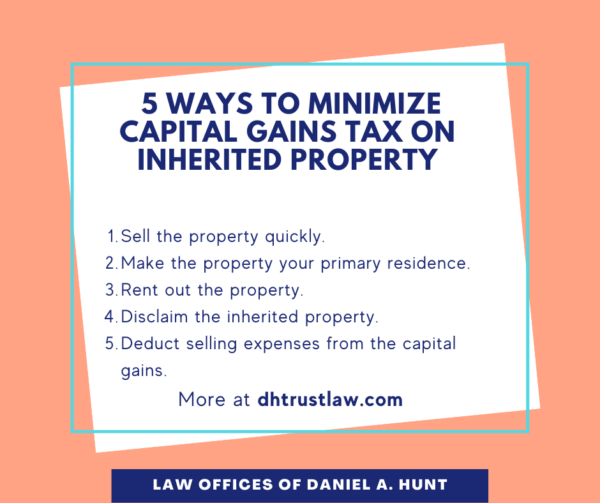

Avoid Capital Gains Tax On Inherited Property Law Offices Of Daniel Hunt

Selling Property In Florida As A Non Resident

Florida Capital Gains Taxes What You Need To Know 2022 Michael Ryan Money

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Biden Proposal Would Close Longtime Real Estate Tax Loophole Mansion Global